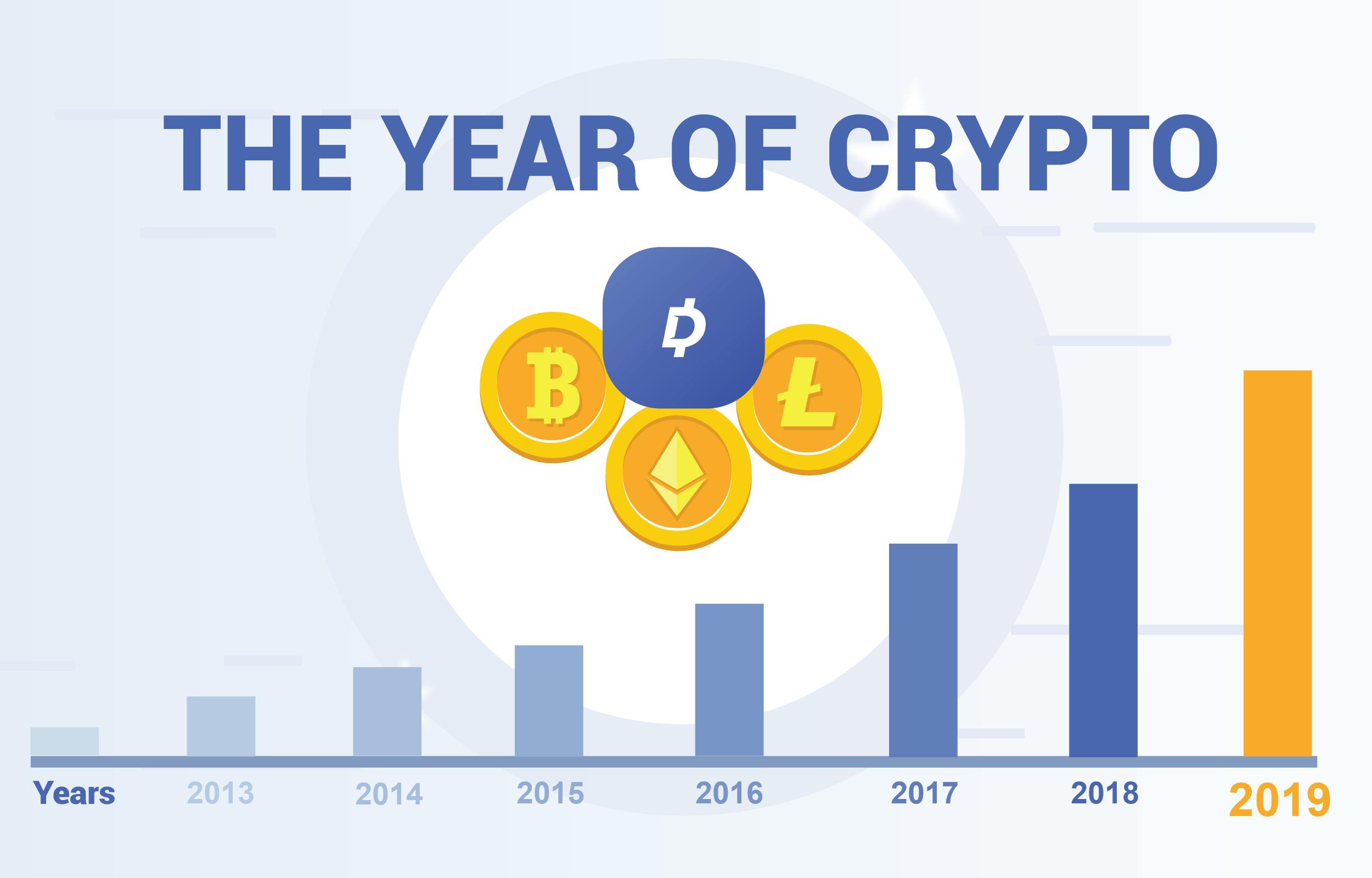

Financial bigwigs and cryptocurrency experts all over the world have dubbed 2019, ‘The year of crypto’. With many predicting that this will be the year that institutional money finally enters the market, recognizing the value, and making the mass adoption of, cryptocurrency a reality. The CEO of NASDAQ, Adena Friedman, has even come out and said that "cryptocurrency deserves an opportunity to find a sustainable future in our economy".

But could the future of finance really lie in cryptocurrency? We say yes.

The Growth of Cryptocurrencies

Back at the dawn of the internet in 1991, many doubters looked at the future of the technology and said, it’s only a fad. How wrong they were. Many now consider the internet as important as the air they breathe, vital to their existence. It’s certainly something that has changed the way that we as humans live.

The exact same could be said for cryptocurrency. What started as an idea, dismissed as a fad, has now garnered over 21 million users worldwide. Now mainstream media attention, pushing consumer understanding and education in blockchain technology, is making the adoption of cryptocurrencies even more appealing.

Which is why, in its brief existence, cryptocurrencies have garnered some staunch advocates from the worlds of old money and new tech.

- Venture capital investor, Tim Draper, has predicted that the total cryptocurrency market capitalization will hit $80 trillion in the next 15 years.

- JP Morgan CIO, Lori Beer, predicted at a press conference that blockchain will “replace existing technology” in the upcoming years. He has revealed that JP Morgan is currently using blockchain technology to simplify the payment process and store customers’ information.

- Kim Dotcom, MegaUpload creator, renewed his belief in Bitcoin. He explicitly told his followers to “buy cryptocurrency” and claims “their USD will become worthless”.

- Robert Kiyosaki, the author of the best-selling finance book 'Rich Dad, Poor Dad', expressed his concerns about the US economy and believes that cryptocurrencies will eventually replace it.

- The CEO of NYSE, the world’s largest stock exchange, claims that Bitcoin has the potential to be the “first worldwide currency”.

Cryptocurrency in 2018

In truth, 2018 was a bad year for Bitcoin and many other major cryptocurrencies. It was the year that saw crypto prices plummet and continue to crash without much respite. So why, then, is there so much positivity in what is currently a very volatile marketplace?

If there is one observation you can make from the crash of cryptocurrency in 2018, it’s that it has done a very neat job of clearing up the sector. The crash shook up the industry, separating the wheat from the chaff, meaning that only bolder, better-realized crypto projects have maintained.

With so many diverse cryptocurrencies still on the table: Bitcoin, Litecoin, Ripple, Dagcoin, etc., does the future of finance lie in blockchain-based technology? Or perhaps in the use of DAG-chain systems?

Bitcoin Future

Bitcoin was not just the first major cryptocurrency but remains to date the most traded in the world. And whilst Bitcoin is still seen as the marketplace’s main currency, and leading indicator of crypto trends, it has come off of the back of a disappointing 2018. This doesn’t mean there won’t be a resurgence in Bitcoin’s value - there has already been a slight leap as of writing in April 2019 - but there are indicators that it might not be the future of cryptocurrency.

Companies like Ethereum and Ripple have gone to great extremes to make sure they have made a name for themselves in the market, Ripple notably working with a range of banking systems across the world to facilitate far more efficient money transfers. Other currencies like Litecoin, Cardano, Tron, Monero, and Steem are also working hard to change the way consumers transact.

All these cryptocurrencies all have one thing in common - blockchain. The issues relating to scalability may not seem like an important factor at this stage, due to small community usage. However, in the context of global usable currencies, something that would require a vast number of transactions, scalability is a crucial element. So while blockchain is the mainstay of many cryptocurrencies, it isn’t necessarily the best option when considering the greatest goal of mass adoption.

DAG-Chain

DAG-chain is the new buzzword in the crypto industry. Even though cryptocurrencies and blockchain have become synonymous with each other, DAG-chain has all the prowess and potential to buck the trend.

Instead of using a block-based system, activated by miners for validation, DAG uses a much more efficient directional process. Directed Acyclic Graphs (DAGs) only need to gain verification from the two closest nodes, scaling back these complex algorithms and eliminating the need for miners. This ensures an almost instantaneous transaction speed and the reduction of costs for all users on the network.

If cryptocurrency is to see radical mass adoption in 2019, it would require the ability to make thousands of transactions per second, at a low cost and in a sustainable way. DAG-chain could accommodate such demands and seems likely to play a big part in the future of cryptocurrency.

Institutional Money and DLT

The time for talk is done. For mass adoption of cryptocurrency to actually happen we need to see its use in the real world of business. Only then will it be integrated on a global scale and can it become the future of finance.

For many, decentralization remains the most important tenet of every cryptocurrency. However, governments and tech giants are starting to realize the potential of blockchain and how it can be adapted to suit bigger corporations. We have already witnessed the beginnings of centralized cryptocurrencies, with fresher faces like Ripple, Stellar and EOS having come under increasing scrutiny from decentralization advocates.

IBM have created their own distributed ledger technology (DLT) and intend to implement it broadly in many of their future technologies. Many more financial institutions, including Citigroup and Barclays, are creating their own DLT to launch blockchain app stores for their customers. Chinese tech giant Alibaba, have filed the most blockchain-related patents applications, with IBM following closely behind and Mastercard in third place. This shows that these conglomerates are not only recognizing the potential of cryptocurrency but actively creating their own systems for widespread use.

As all these organizations and technologies evolve, their real-world usage will increase exponentially. This will reduce many speculative market elements and ground the technologies’ successes in actual performance, form, and function. And with the emergence of DAG-chain technology providing a suitable solution to the pitfalls of blockchain, the future of cryptocurrency certainly looks exciting.