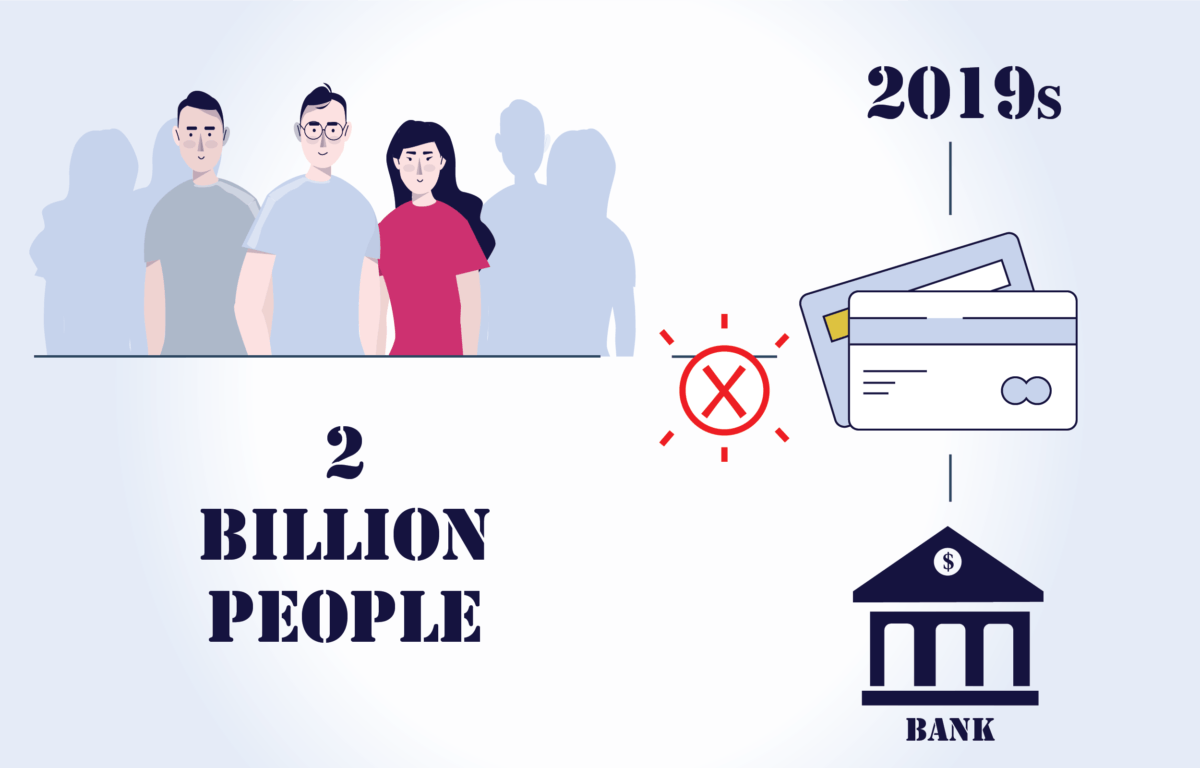

Today, more than 2 billion people around the world still don’t have access to a bank account. That is almost a 1 in 4! A truly staggering statistic in 2019 when we look at all the technology around us. But what is stopping all these people from opening an account?

There is just one answer… The banks! These 2 billion people - often some of the poorest in the world – are just not seen as profitable by the banks. It is this thirst for profit that is keeping these people poor because without an account, not only do they not have a place to save their money or be paid to, they have no means to borrow.

Not being able to borrow means; they cannot get a student loan to get the qualifications they need to get a better job, to invest in expanding their business or to start a new one. The saddest part is, often these people have a steady income and expenditure, just no way of proving it.

In this week’s blog we will further explain the benefits cryptocurrencies bring for those trying to create and build a credit history. But, before we do, we must first explain…

The Restrictions of Cash

Most of you have probably heard the saying “cash is king” and probably more times than you care to remember. And throughout the world, cash still remains king. According to G4S cash is still used in more than 50% of all transactions around the world. You might think this is skewed by statistics in poorer countries. However, in Europe over 60% of transactions in shops and restaurants are still made with cash, and the same goes for the US.

However, it is when cash becomes your only form of payment that you hit roadblocks. The first of these is that you are restricted to only buying goods and services in your local area, and in person. Say goodbye to those cheaper online deals. But that is only the tip of the preverbal iceberg.

Want to send money to a friend or family member even in a neighbouring town or city – with cash that becomes very difficult or the methods unsafe. However, the biggest problems start to come when you get paid, because without a bank account there is only one way to be receive your salary – in cash. Being paid in cash restricts people to the lowest level jobs or those sectors or companies that may be less law abiding when it comes to taxes and registration for health care and other state benefits.

More expensive products and services, lower paid jobs, less or no access to healthcare and other state aid. It’s much more serious now, right? But it gets worse…they have less chance of improving their lives because they also cannot borrow. Whether that investment is in theirs or a family member's education or business, a bank will simply not lend money when a person cannot prove how much they earn and how they spend their money.

However, there is a solution…

Crypto Credit History

With cryptocurrency, people can buy products and services from anywhere in the world. With that, not only is there the possibility to buy things for a cheaper price, but a chance to buy things that are currently not available locally. And this isn’t just for individuals, local merchants can also save money when buying stock, or expand by providing new products.

In turn, new merchants can also enter the market to provide these products or services. Because merchants have the possibility to buy products for a lower price this means that things in the shops will also be cheaper. Making lives easier even for those people still using cash. Amazing, right? But it doesn’t stop there…

Want to send money to a friend or family member. You can now send it safely and quickly. It doesn’t matter if they live in the next town or halfway around the world.

Crypto doesn’t just give people a safe place to store their money, spend it and send it, it also gives them somewhere secure for their salary to be paid too. This makes it much easier to pay taxes and receive health, education and other state benefits. And, not only that, seek better paying employment. But it gets even better!

People using cryptocurrencies - such as Dagcoin - can, in the future, prove their income and expenditure making it possible to apply for a loan. It is hard to explain the massive impact this can have not just for individuals and families, but also entire communities. Imagine obtaining a loan to send your child to university (they will be the first in the entire family to go), the knowledge they gain enables them to get a great job or start a business that doesn’t just support them, but their entire family.

Also, imagine a local business owner who can now borrow to invest in new products or machinery that enables them to grow from being a local company to a national or international one. Employing more people in the local community, paying better salaries and providing more benefits.

Having access to digital money gives people a banking history and a credit score. Dagcoin gives these 2 billion people the possibility to improve their lives themselves, without any barriers except their own imagination and drive to succeed.

Conclusion

Having the possibility to borrow money comes as second nature to most of us. We might not just be paying for a mortgage or car as part of a loan or payment plan, but all kinds of household items and tech.

But for those without access to a bank account, these luxuries are far from people’s minds. It is being able to borrow money to go to school, start a business or expand an existing one. But when you don’t have a bank account and all your transactions (including receiving your salary) are in cash. You have no chance of getting a loan, because you have no credit history, or means to prove you can pay it back.

By using a cryptocurrency like Dagcoin, people finally have the chance to receive their salaries to a safe and secure place, pay their bills and buy goods or services. And, in doing so, build a credit history.

The possibilities this brings to people and even entire communities are enormous. A loan for one small business could enable them to expand nationally or internationally, employing more people and paying better salaries, while at the same time providing cheaper products for those people still using cash.

Cryptocurrencies remove the blocks placed by banks hungry for profits and give the poorest people in the world a banking option that will help them to achieve their dreams.

Join a growing community of nearly 300,000 people using Dagcoin.