We believe that money belongs to us

When our wages get paid to our bank accounts we think that this money belongs solely to us. And that no one else owns it or has power over it. We have earned it, we will spend and save it however we choose. At least that is how it appears.

However, in today’s world, it is almost guaranteed that our money actually has many “owners”. What do we mean by that and how is it possible?

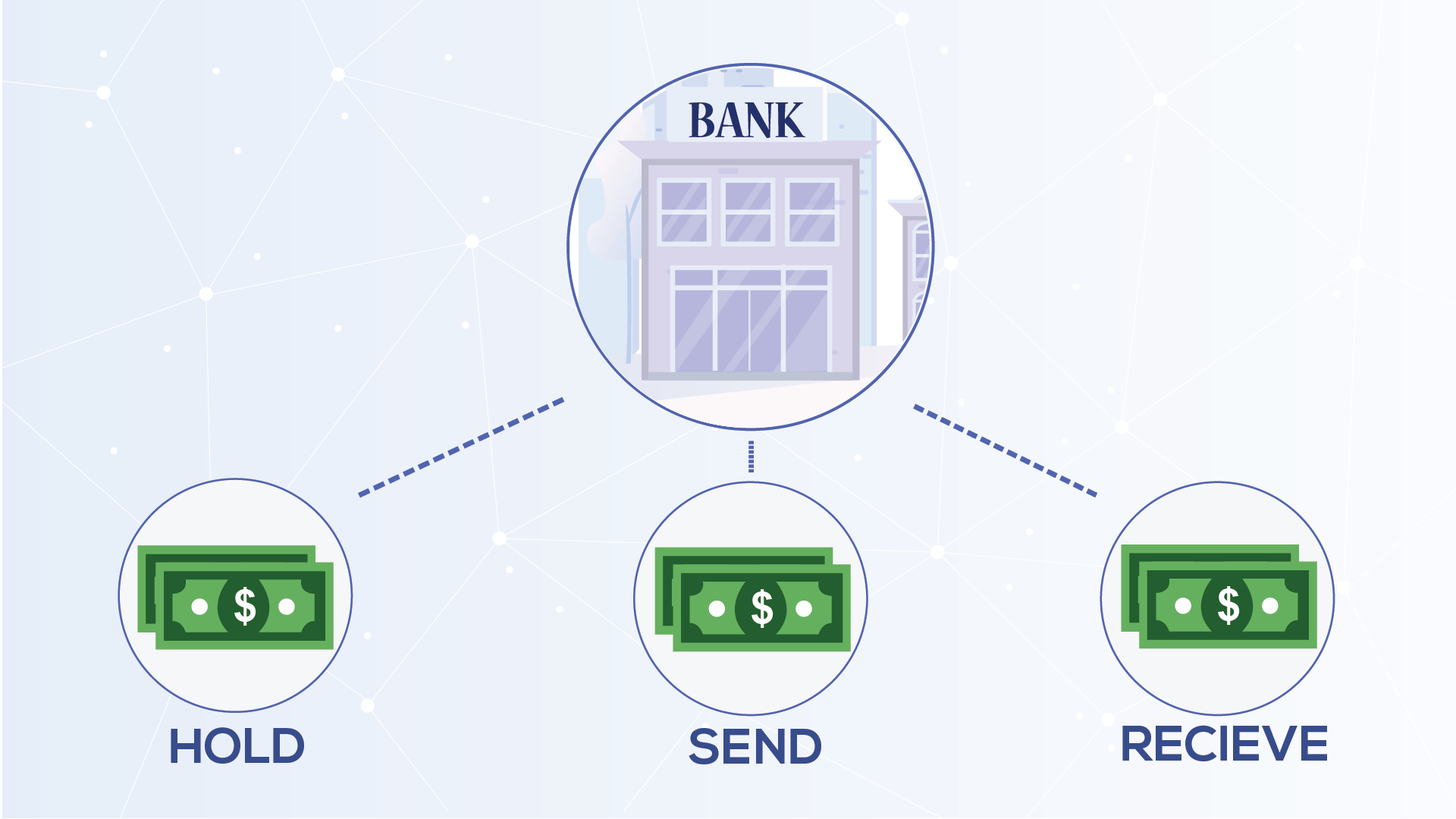

If your money is in a bank, then the bank is seen as the 2nd owner of that money. Some people go as far as saying that once your money is in the traditional banking or credit card system, that you actually turn over control of your money to many other third parties as well. These could be the government, service providers, or even other financial institutions.

How much power do others have over our money?

The minute you put your money in the bank, you give the bank the power to invest your money in whichever way it wishes and to loan it to whoever they like. The bank has to do this because it needs to be able to make money from your money in order to pay employee wages, rent bank locations, pay dividends to shareholders, etc.

However, whenever the bank makes an investment it is taking a risk that some or all of this money may not return. If we go back a decade ago to the great financial crisis. Banks across the globe had invested in US subprime mortgages that were seen as a sure-fire return due to their high credit rating. However, these turned toxic as it became more and more apparent that this money had been lent to those who were unable to pay it back. This led to many banks scrambling to sell this debt and others knowing there was little to no chance of ever seeing that money return.

The impact of this was that the banks themselves were now in debt, as not only had they used account holders money to make investments, but they had also borrowed heavily to do so. In many countries around the world, central banks were able to bail out failing banks with loans or guarantee the savings of bank customers, but this was not possible in Iceland.

The 3 major Icelandic banks had amassed a debt of over $50 billion, seven times the GDP of the country. Because the amount of debt far outstripped the economy, the central bank was unable to act as a lender of last resort as was possible in countries like the UK. For this reason, all 3 banks were liquidated by the financial service authority and new ones created. Their major aim is to secure domestic deposits. This meant that not only did shareholders lose their money overnight, but also nearly half a million foreign nationals who had accounts with the 3 banks.

It doesn’t have to take a financial crisis or a bankrupt bank for you to lose your money. We’ve all heard or even experienced cases where accounts are closed without notice for breaching terms of service. To get this money back or even to reopen the account requires the account holder to jump through all sorts of hoops or legal actions. This kind of power also extends to the government, who have the ability to seize control of accounts, savings, and even personal pension assets.

Despite these potential problems, putting your money in the bank has been the safest and best option for a long time. However, that is not the case anymore…

Taking Back Control with Crypto

Perhaps the greatest of all advantages of cryptocurrency is that unless you’ve delegated management of your wallet over to a third party service, you are the sole owner of the private and public encryption keys that make up your cryptocurrency network identity or address. No one but you has the power to withdraw cryptocurrency from your wallet.

This means that even though a financial crisis may reduce the value of your cryptocurrency, that is the worst thing that can happen. You don’t have to worry about what may happen to your money if your bank goes bankrupt, or the government seizing your assets. Further still, I am sure there have been times for almost all of us when an expected bill or direct debit has been taken from your account when you really needed that money to buy groceries or something crucial. Being able to send all payments yourself, means you pay your bills when its best for you. Removing unnecessary stress, heartache and worry.

Lastly, but not least, because there are no terms of service to downloading and using a cryptocurrency wallet, your account will never be closed or access removed. This can happen far easier and unknowingly than you can imagine with a bank. With cryptocurrency, you never need to be in a position where you are having to jump through all sorts of hoops to gain back access to money that is rightfully and lawfully yours.

All these benefits give you ultimate control and power over your money, while at the same time providing a safer and more secure place for your money.

Conclusion

When we put our money in the bank we give away power and ownership of our money. This is needed in order for the banks to invest or loan out our money. This way they can earn enough from it to provide us with a banking service and pay staff, rent and shareholders.

However, banks sometimes lose our money. For example, during the financial crisis, nearly 500,000 people who had accounts with the 3 major Icelandic banks lost not only access to their accounts as the banks fell into liquidation but also for many of them all or a vast majority of the money they had saved.

You can also lose access to your bank account if you are deemed to have broken bank terms and conditions or as a result of a government seizure.

With crypto’s only you and you alone have the necessary information to send money from your wallet. This means that no one else can take money from your wallet or gain control over it. Even in the worst case scenario of a financial crisis, your money is always safe, secure and under your control. Are there any more benefits you would add?