The DAG-chain and Dagcoin have many benefits which make them more viable and suitable for a worldwide use than fiat and Blockchain-based currencies. In this blog, let's talk about those advantages.

Transactional Efficiency

Due to its increased use, blockchain transactions are taking longer and longer to verify. Block confirmations create scalability issues, requiring more and more miners to progress. At the same time, mining is itself set to become even more tumultuous because of Bitcoin’s ‘Halvening’ - the amount of reward per block is decreasing all the time, cutting in half every four years. This shifting reward system means that the currency itself remains speculative and volatile.

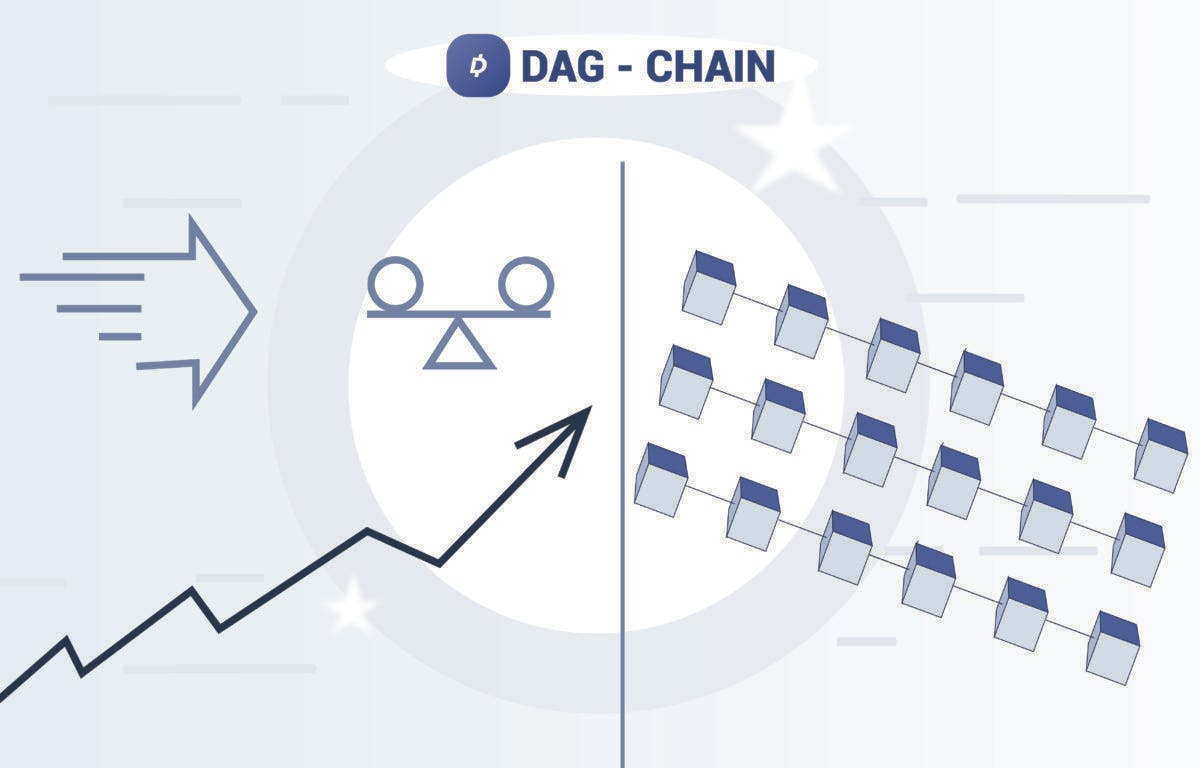

DAG-chain, on the other hand, increases the speed and stability of transactions as the user network grows. Equally, the passing of information is not limited to one chain but can be spread in parallel allowing more than one chain to exist at any one time.

You see, the network consists of nodes connected to each other with Edges. An Edge refers to a connection with a specific direction and makes it impossible to send information back in the opposite direction. Instead of adding blocks of data to a chain, confirmation is parallelized, resulting in higher processing rates. This acyclic system means that it is not able to encounter the same node from before, cutting out a lot of unnecessary time and computational power which will eventually make transactions instantaneous.

Lower Transaction Fees

Previously, if a transaction was complex in nature and required more computational power, it would result in higher transaction fees or even failures. Additionally, as the blockchain grows over time, nodes will require a higher storage capacity and greater bandwidth to keep up with its ever-increasing demands.

When using DAG-chain technology, no matter what information or value is being sent, each transaction has the same, small, fixed fee attached. DAG only needs to gain verification from the two closest nodes, scaling back these complex algorithms and eliminating the need for miners. This ensures the reduction of costs for all users on the network.

Decentralization

The hardware costs associated with the increased level of mining has seen a rapid rise in centralization under blockchain. Corporations with the capital to invest have been rapidly erecting massive mining farms, seeking to gain as much of the mining reward as possible.

DAG technology's sequential solution and increased efficiency mean that the same financial incentive doesn’t exist, and is, therefore, less prone to susceptible interest.

Security

As hardware becomes more powerful (and if quantum ever became a reality), solving cryptographic algorithms will become far, far easier. At the same time, blockchain is hypothetically susceptible to ‘51% Attack’, through which miners could control over 50% of the network. These attackers could prevent new transactions and reverse transactions that were completed while they were in control of the network, meaning they could, amongst other things, double-spend coins.

The multi-point connections of DAG technology’s logic ensures that tampering with records is impossible and that a 51% attack could never happen.

Eco-Friendliness

To handle blockchain's ever-growing popularity, a huge amount of computational power is required to complete the most simple transaction. As such, mining Bitcoin requires a lot of electricity. A lot. In 2017, it was noted that mining used somewhere in the region of 30 terawatt-hours alone. That’s as much electricity as it takes to power Ireland.

DAG-chain transactions are conducted without any physical mining and are therefore far more energy efficient. That’s because every transaction is validated by the transaction itself, cutting costs to network users as well as cutting down on energy consumption.

The Future of Cryptocurrencies?

Issues relating to scalability and cutting time on the execution of smart contracts makes DAG an attractive prospect. While some blockchains continue to clog up their network causing slow transaction and high fees, DAG can be used for applications that require thousands of transactions per second.

Many believe that 2019 will be the year in which institutional money will finally enter the cryptocurrency market. And if consumers and businesses alike realize DAG-chain’s fast, unlimited exchange and low cost, all while maintaining a decentralized system, then it could be the first major step towards mass adoption and the creation of a worldwide currency.